Market volatility is a perpetual companion in the realm of finance, leading to variations in the prices of assets that can be uncertain and disconcerting. For individuals who contribute to the Thrift Savings Plan (TSP), it is crucial to comprehend how to navigate through the fluctuations of the market in order to effectively plan for retirement. This article will delve into the characteristics of market volatility, the significance of TSP in long-term retirement planning, and provide practical approaches for TSP participants to prosper despite uncertainties in the market.

Understanding Market Volatility

Market volatility is the statistical measure of the dispersion of returns for a given security or market index. In simple terms, it reflects the degree of variation of a trading price series over time. While viewing volatility as a negative force might be tempting, it’s important to recognize that markets wouldn’t offer potential for returns without it. Historical instances of market volatility, such as the 2008 financial crisis, have shown that markets can recover over time, and those with a long-term investment horizon are better positioned to weather such storms.

The Role of TSP In Long-Term Retirement Planning

The Thrift Savings Plan is specifically designed to withstand market fluctuations over the course of a federal employee’s career. Participates in a disciplined, long-term approach to retirement investing by contributing to TSP. The power of compound interest and dollar-cost averaging can work in their favor, smoothing out the impact of market volatility over time. It’s essential to recognize that short-term fluctuations are a natural part of the investment journey, and TSP is structured to help participants stay the course.

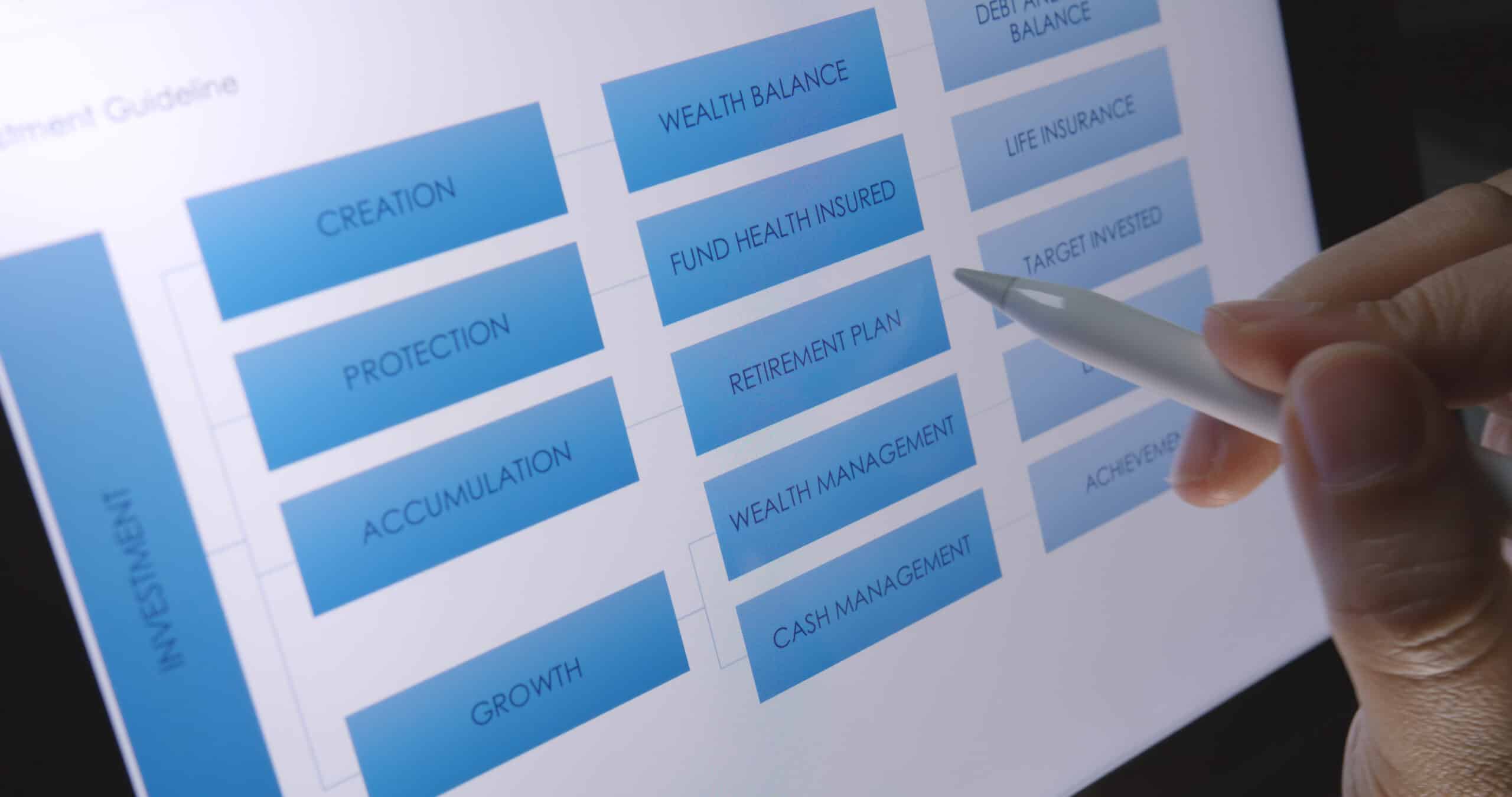

Diversification Strategies In TSP

Diversification is a cornerstone of risk management in investment portfolios. TSP participants can diversify their investments across different asset classes, such as stocks, bonds, and international funds. This approach helps spread risk and minimize the impact of poor performance in any area. By maintaining a well-diversified portfolio, TSP participants can position themselves to endure market turbulence more effectively.

TSP Lifecycle Funds: A Hands-Off Approach To Market Volatility

For those who prefer a more hands-off approach, TSP offers Lifecycle funds. These funds automatically adjust their asset allocation based on the participant’s time horizon to retirement. In times of market volatility, these funds provide a passive strategy, reducing the need for constant monitoring and decision-making. Participants can set their contributions to align with the targeted retirement date, allowing TSP to handle the complexities of adjusting the asset mix over time.

Market Timing: The Pitfalls And Risks

Attempting to time the market—predicting when to buy or sell investments based on expected future price movements—is a strategy fraught with risk. Research shows that even professional investors struggle to consistently time the market successfully. TSP participants are better served by adopting a long-term perspective and staying invested through market cycles.

Reviewing And Rebalancing Your TSP Portfolio

Regularly reviewing and rebalancing a TSP portfolio is a proactive strategy to ensure it stays in line with long-term goals. During periods of market volatility, certain asset classes may experience more significant fluctuations, leading to an imbalance in the portfolio’s original allocation. By rebalancing, participants can realign their portfolio with their risk tolerance and investment objectives.

The Psychological Aspect: Emotions And Decision-Making

The emotional aspect of investing cannot be overemphasized, especially during periods of market volatility. Fear and greed can cloud rational judgment and lead to impulsive decisions. TSP participants should recognize the psychological challenges and develop strategies to manage emotions. Maintaining a disciplined approach, focusing on long-term goals, and seeking guidance from financial professionals can help participants navigate the emotional roller coaster of investing.

TSP Resources For Monitoring and Understanding Market Trends

TSP provides a range of resources to assist participants in making informed decisions during market fluctuations. These include online tools, market updates, and educational materials. TSP participants are encouraged to leverage these resources to stay informed about market trends and make decisions aligned with their financial objectives.

Case Studies: TSP Performance During Previous Market Downturns

Examining historical TSP performance during significant market downturns can offer valuable insights. In past crises, TSP has demonstrated resilience and the ability to recover over time. Case studies provide real-world examples of how TSP has weathered market storms, reinforcing the importance of a long-term perspective.

Tips For Communicating With A Financial Advisor

During market volatility periods, a financial advisor’s role becomes crucial. TSP participants may benefit from consulting with a financial professional to gain perspective and make informed decisions. Effective communication with a financial advisor involves articulating financial goals, understanding risk tolerance, and working collaboratively to navigate the challenges presented by market fluctuations.

Conclusion

Investing in the market comes with its fair share of ups and downs, known as market volatility. However, TSP participants can effectively navigate these fluctuations by adopting an informed and disciplined approach. By gaining a deep understanding of market volatility, utilizing the unique features of TSP, and implementing strategies like diversification and regular portfolio review, participants can increase their likelihood of achieving financial success in retirement. It is crucial to remain focused on long-term goals and embrace sound investing principles, allowing TSP to serve as a dependable tool for building a secure financial future.